Embracing the adage, ‘Don’t put all your eggs in one basket,’ portfolio diversification strategies become crucial for investment success. Putting all your money into a particular industry or asset may lead to financial losses when the asset performs poorly. This is why you need to go for diversification.

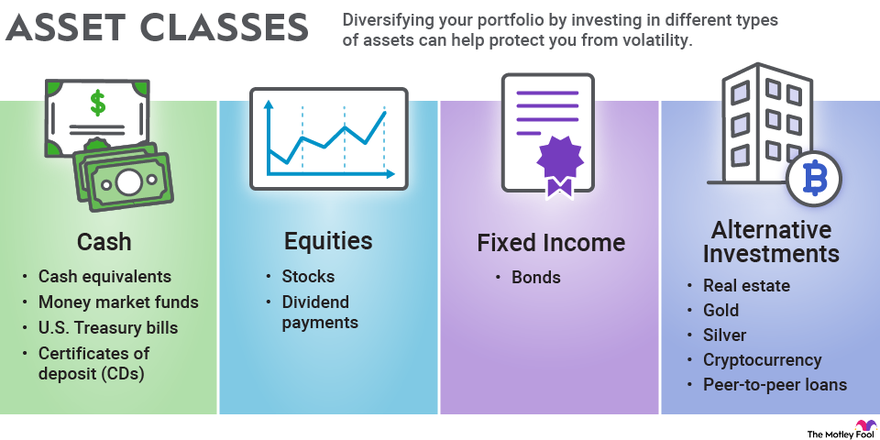

Diversification of a portfolio involves spreading your money across several asset classes, industries, or geographic regions to minimize the overall risk of the portfolio. When you have a mix of investments, the poor-performing investment can be offset by the better-performing investment. As a result, you earn more consistent returns in the long term. Diversification often involves investments in different asset classes like stocks, bonds, real estate, or cryptocurrency. In addition to this, you can invest in companies and foreign markets as well.

In this article, we will outline the practical ways to diversify your portfolio for long-term wealth growth. But before that, let’s look at the benefits of portfolio diversification.

Benefits of Portfolio Diversification Strategies

Diversification is an important principle in investment. It helps in building a strong portfolio. Understanding the benefits of effective portfolio diversification strategies is key to a robust investment plan.

- Mitigates investment risks. No investment is without risk. Having said that, diversifying investments across different asset classes helps in minimizing the overall risk of your portfolio. For example, if you invest all your money in a single stock and the stock performs poorly, you will suffer losses. On the other hand, if you diversify your investments across several stocks, bonds, and mutual funds, the decrease in value in one stock will not affect your overall portfolio. This is because the losses of a single stock would be offset by the profits of high-performing stock.

- Provides an opportunity to grow. Diversification means putting wealth in several investments, including stocks, bonds, industries, sectors, etc. This allows you to tap into new emerging sectors that have a promising future, giving you the opportunity to grow.

- Optimizes returns. By diversifying, you can optimize returns. Diversifying allows you to capitalize on different types of returns, regardless of the market condition. For example, when you add stocks and bonds to your portfolio, you can earn returns from both, regardless of market condition. Stocks perform well when the market expands, while bonds perform well during the market downturn. So, here, you can earn returns in different market conditions.

- Offers consistent returns. The stock market is volatile. So, investing only in stocks cannot give consistent returns. However, investing in different asset classes ensures consistent returns.

- Provides liquidity. Many prefer safe investment options like fixed deposits. Fixed deposits are safe, but in an emergency, they can be troublesome. They have lock-in periods, which means you need to pay a hefty fine to withdraw cash from fixed deposits. On the other hand, when you mix safe investments with liquid investments, you can get cash quickly whenever you need it without paying a fine.

Seven Ways to Diversify Your Portfolio for Long-term Wealth Growth

Building a diversified portfolio is a daunting task. Here are some tips that make it easy for you to diversify.

Strategy 1: Diversify with Multiple Stocks – A Core Portfolio Diversification Strategy

Investing in several stocks is one of the quickest ways to diversify. When you invest in multiple stocks, make sure you invest in at least 25 companies. When investing in multiple companies, remember they should represent a variety of industries. It is easier to invest in companies representing the same industry, but that’s not proper diversification. If the industry takes a hit due to an economic downturn or due to other reasons, all the companies’ shares take a hit, and as a result, you suffer losses. This is the reason to invest in multiple stocks representing different industries.

Investing across diverse sectors and industries minimizes risk by spreading exposure. This strategy capitalizes on the unique growth trajectories and risk factors of different markets. For instance, while tech stocks may surge due to innovation, healthcare stocks could provide stability during economic downturns, as demand for healthcare services remains constant.

Moreover, diversification within stocks extends to market capitalization, including a mix of large-cap (established firms), mid-cap (medium-sized companies with growth potential), and small-cap stocks (smaller companies with higher growth potential but greater risk). This blend ensures that investors can benefit from stability and growth, optimizing their portfolio for long-term wealth accumulation. Engaging with a broad spectrum of stocks also allows investors to capitalize on emerging trends and sectors, further enhancing portfolio resilience and growth prospects.

Strategy 2: Spread the Wealth Across Asset Classes – A Fundamental Portfolio Diversification Strategy

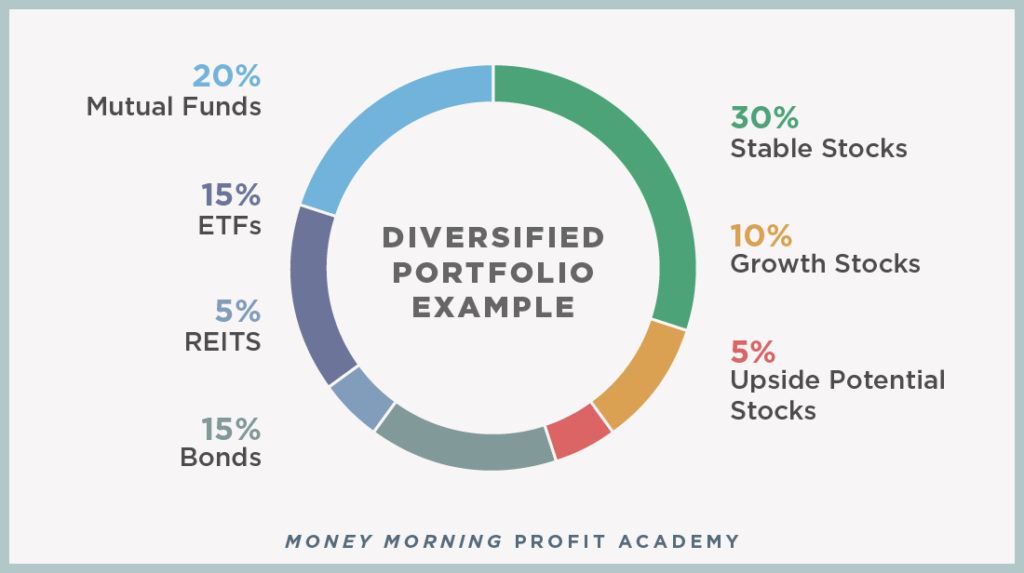

When we say “spread the wealth,” it doesn’t mean investing in only stocks and bonds. Many investors think that the combination of stocks and bonds is true diversification. No, it is not. You should expand your portfolio in addition to stocks and bonds. You can also invest in financial instruments like mutual funds, exchange-traded funds, real estate investment trusts, gold, and real estate, to name a few. When investing in them, don’t stick to your home base. Go beyond your home base. Go global. This way, you will spread your risks, leading to bigger rewards. Remember, spreading wealth doesn’t mean putting your wealth in 100 different investments. Try to limit yourself to about 20 to 30 investments.

Diversifying across asset classes is more than a risk management tactic; it’s a strategic approach to capturing growth in different economic conditions. For instance, while stocks offer capital appreciation potential, bonds can provide steady income, acting as a buffer during market volatility. Real estate and gold, often considered ‘safe havens’ during turbulent times, add another layer of security and potential inflation protection.

Furthermore, incorporating alternative investments like commodities, cryptocurrencies, or private equity can offer uncorrelated returns, potentially boosting overall portfolio performance. Importantly, diversification must be tailored to individual risk tolerance, investment goals, and time horizon, ensuring a well-rounded portfolio that can withstand market shifts and capitalize on growth opportunities across the global economy.

Strategy 3: Embrace Index Funds – Simplifying Portfolio Diversification Strategies

Index funds are the best way to diversify your portfolio at a low cost. An index fund is a type of mutual fund or ETF, which has hundreds of stocks sharing common characteristics like being part of a particular industry, market size, or geographic region. When you purchase an ETF or mutual fund, you own every stock in that index. This approach is easier than creating a portfolio from scratch.

Index funds not only simplify the diversification process but also align with the principle of passive investment, offering a low-effort, cost-effective entry into the stock market. By mirroring the performance of a specific index, these funds reduce the risks associated with individual stock selection and the need for constant portfolio rebalancing. This strategy is especially beneficial for long-term investors seeking to capitalize on market growth while minimizing fees and active management complexities.

Over time, the compound effect of these advantages can significantly impact wealth growth, making index funds a cornerstone of a diversified investment strategy. Embracing index funds means investing in the broader market’s potential, leveraging the collective growth of numerous sectors and companies.

Strategy 4: Add Cash to the Mix – A Conservative Portfolio Diversification Strategy

Allocate cash to your investment portfolio. Having cash in your investment portfolio offers several benefits, which are as follows:

- Liquidity and flexibility. Cash is a liquid asset, meaning you can convert cash into other forms of value like an investment. When investment opportunities arise, you can use cash to buy stocks during downturns or invest in IPOs (Initial Public Offerings).

- Manages risks. The market is unpredictable. Anything can happen. There can be sudden market downturns. In this situation, having cash as a portion of your portfolio can be beneficial. You can use it to cover unforeseen financial needs instead of selling other investments at unreasonable prices. This minimizes the risks of making rash decisions during market stress.

- Cash allows funding, especially during a market correction. A market correction means a decline of 10% or more in the price of stocks and other assets. In simple words, assets are undervalued during a market correction. In such a situation, cash comes in handy. You can use the cash and purchase the undervalued assets and benefit from their future appreciation.

- There is diversification in cash. Cash can be held in different forms including in the form of saving accounts, short-term government bonds, etc. This diversification in cash allows you to earn slightly higher returns.

Strategy 5: Know When to Get Out – Mastering Exit Strategies in Portfolio Diversification

Holding on to investments is a sound strategy, but that doesn’t mean you should hold onto them forever. Stay abreast with all the changes that are happening in the market. Always be on the lookout for what is happening to the companies that you have invested in. This will help you identify the right time to sell the investments and move on to the next investments.

Effective portfolio management is not just about selecting the right investments but also knowing when to exit them. This involves setting specific criteria for selling, such as target profit levels, maximum loss thresholds, or fundamental changes in a company’s prospects. Regularly reviewing and adjusting your portfolio in response to market dynamics can protect gains and limit losses. Incorporating stop-loss orders or setting rebalancing intervals can automate some of these decisions, ensuring you remain aligned with your investment goals and risk tolerance. Mastering exit strategies is a dynamic component of portfolio diversification, enabling you to navigate market cycles more effectively and secure your financial future.

Strategy 6: Invest Globally – Broadening Horizons with International Portfolio Diversification Strategies

Just like the adage “Don’t put all your eggs into one basket,” similarly, don’t have all your investments in the US. Spread your investments across the globe. There are many attractive investment opportunities outside the US, especially in emerging markets like China and India. When you invest in emerging markets, you can potentially earn higher returns. Markets like China and India grow at faster rates, and the companies that are operating there benefit. When you invest in those companies, you can also earn high returns.

Diversifying internationally exposes your portfolio to the world’s fastest-growing economies, offering a buffer against local market volatility and the opportunity for enhanced returns. Investing globally allows you to benefit from different economic cycles, currency movements, and market conditions, diversifying your risk further. Moreover, some foreign markets offer higher dividend yields or unique opportunities in sectors not as prevalent in the U.S. market. However, it’s important to consider the risks, such as political instability, currency fluctuations, and differing regulatory environments. Employing a thoughtful approach to international investing, such as through globally diversified funds or ETFs, can mitigate these risks while capitalizing on the growth potential of markets worldwide.

Strategy 7: Invest in Target-Date Funds – A Simplified Approach to Portfolio Diversification

Another great way to diversify your investments is by investing in target-date funds. A Target-date fund is a mix of different types of stocks, bonds, and other investments in a single solution, making you ready for your retirement. To understand target-date funds, let’s take an example. The “Retirement Fund 2030” is a target-date fund that is designed for individuals who are going to retire in or near 2030. In the beginning, the fund has a mix of investments and then changes when it approaches the retirement date. The funds begin with riskier assets like stocks and, over time, shift to the safest investments like bonds. The target-date funds are often available with 401(K) plans.

Target-date funds offer a straightforward, hands-off investment strategy that aligns with your retirement timeline, adjusting the asset allocation to become more conservative as you near retirement. This dynamic reallocation reduces the need for individual investors to actively manage their portfolios, ensuring a balanced mix of growth potential and risk reduction over time. Such funds are designed to simplify the investment decision process, making them an ideal choice for those seeking a diversified portfolio without the complexity of selecting and rebalancing multiple assets. By investing in a target-date fund, you’re leveraging the expertise of fund managers to navigate the changing economic landscapes, ensuring your retirement savings are optimized for both protection and growth as you approach your golden years.

Can I Over-diversify My Portfolio?

Yes, it’s indeed possible to over-diversify your portfolio, which, contrary to common belief, might not always be beneficial.

Over-diversification can dilute your returns, as spreading investments too thinly across a vast array of assets may limit your potential for significant gains from high-performing investments. Managing a highly diversified portfolio becomes a daunting task, often leading to oversight and inefficiency in tracking the performance of each investment.

Furthermore, the cumulative effect of fees from numerous holdings can significantly erode your overall returns. Each additional asset increases complexity, potentially masking underperformance and hindering your ability to make timely adjustments.

While diversification aims to reduce risk, there’s a tipping point beyond which additional benefits diminish, and the costs, both in terms of fees and manageability, begin to outweigh the advantages.

To Sum Up

Diversification is taking steps to protect yourself from an uncertain future. It is a strategic approach that promotes long-term wealth growth by capitalizing on different investment opportunities. To develop a solid, diverse investment portfolio, you need to spread your wealth across different asset classes and sectors.

In addition to this, you have to review your portfolio, consider index funds, invest globally, and perform other investments listed in this article. By doing all these, you can achieve long-term wealth growth. If you find it difficult to apply these strategies, consider consulting a financial advisor. A financial advisor has the ability to tailor a diversified portfolio that is according to your specific requirements.