The COVID-19 pandemic reshaped the business landscape, turning struggling sectors into overnight successes. Industries like video conferencing, home fitness, and e-commerce soared as global populations adapted to lockdown life. However, as we transition into a post-pandemic reality, these once-thriving companies are now encountering the “Post-Pandemic Decline.” This phase brings new challenges as their extraordinary growth stalls.

The downturn is marked by diminishing valuations as societies revert to pre-pandemic norms. This article delves into the fates of these pandemic winners, examining the downturns they face and what lies ahead in this new phase of economic recalibration.

Companies in post-pandemic decline

Zoom’s accelerated growth slowing down

Zoom, essentially a business communication software, became a lifeline for social communications during long and continuous lockdowns. As a Guardian article noted:

“By March, 200 million people were on [Zoom] each day to work, socialize, view lessons and lectures, sing in choirs, attend church, birthday parties and weddings, meet new babies, say final words to dying family members and observe Ramadan and Easter.” (Kalia, 2020).

Fast forward to 2024, Zoom has over 300 million daily active users who use the video-conferencing app every day, but none of the explosive growth rate of the pandemic years. For perspective, the company reported an annual revenue of $0.62B in 2020, an 88% jump from the previous year, growing to $2.65B in 2021 or a whopping 326% increase, followed by a smaller but still impressive jump to $4.10B in 2022. Revenues in subsequent years are telling, growing marginally to $4.39B and $4.53B in 2023 and 2024, respectively.

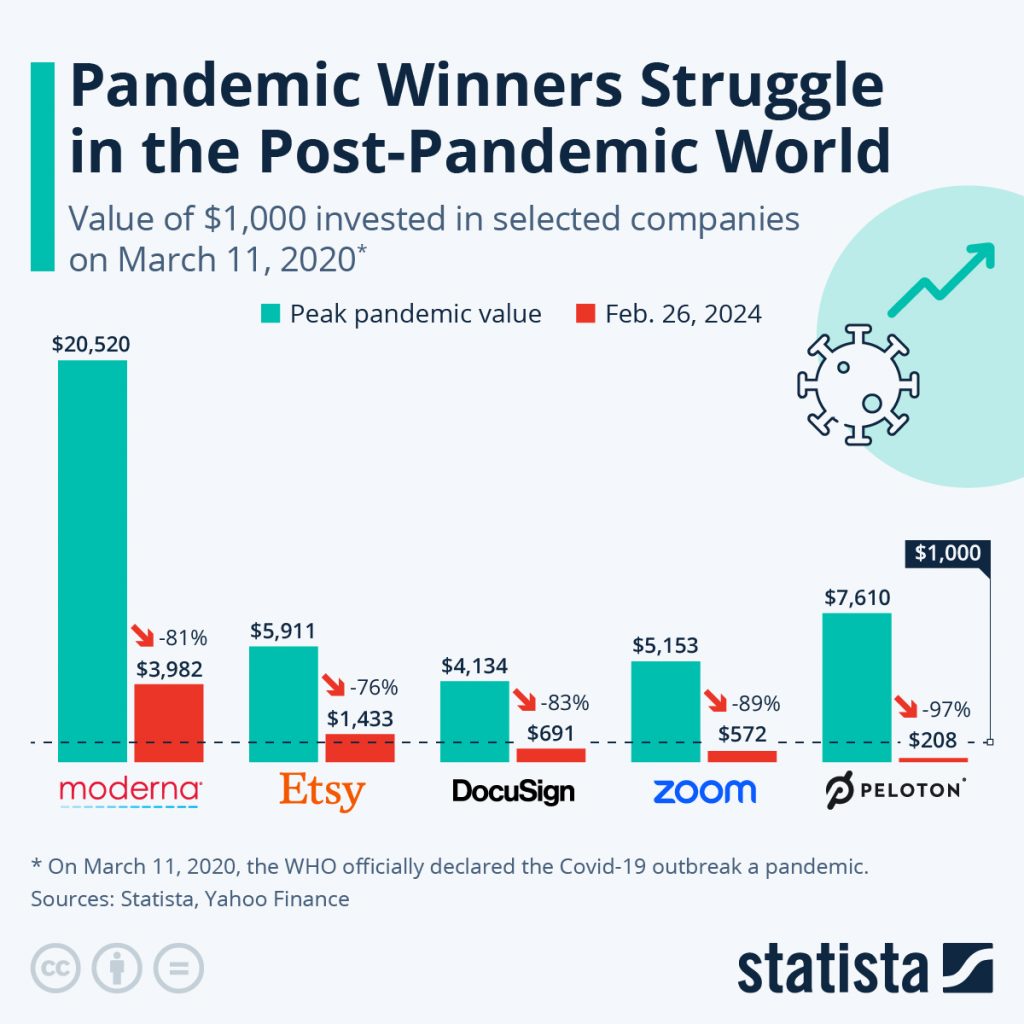

As the chart above indicates, a $1,000 investment in Zoom in March 2020 would have reached $5,153 at the peak of the pandemic. Four years later, its value has fallen to $572.

Zoom wasn’t intended to be an everyday online meeting facilitator for people. Despite a surge in demand during the pandemic, the company failed to monetize demand from consumers, many of whom were content with free 40-minute calls. This and the weaker post-pandemic growth have returned Zoom to corporate customers, its original users. Online research suggests that Zoom plans to sell more videoconference licenses and expand its line of collaboration tools to add phones, a Slack-like persistent chat platform, digital whiteboards, customer contact centers, and physical conference room set-ups. The expanded features are available with Zoom One plans for business and personal use.

Peloton facing a bumpy ride

Peloton sells indoor exercise bikes that include a subscription to its streaming workout content, which you can access even without the bikes. For a monthly fee, you can stream unlimited strength, yoga, running, boot camp, and cycling classes, as well as audio-only classes for outdoor runs.

Like Zoom, Peloton was in demand during the lockdown, when gyms and fitness centers shut down, and people had no choice but to take their workouts indoors. In 2020, the company reported that 1.1 million people downloaded its app in six weeks, bumping up shares to a record high.

At the height of the pandemic, the company’s stock surpassed $171 per share, and market capitalization reached about $50 billion. In 2022, the company’s momentum began falling rapidly. It laid off over 5,000 employees, lost four top executives, and saw its share price drop to $29, dipping as low as $6.62. At the time of writing, the stock’s 52-week range was between $3.96 and $12.02. If you have $1,000 worth of Peloton stock, you’d be over $6,000 richer at the peak of the pandemic but left with a little over $200 this February.

With life returning to normalcy, fitness enthusiasts have resumed their gym visits in a reflection of the social phenomenon known as fitness culture, where gym sessions are a tool for connecting with others. Countries lifting lockdowns wasn’t the only thing that worked against Peloton. The company’s logistics buckled under the unexpected demand. As waiting times for equipment began to get longer, Peloton fans took to social media to vent their frustration. To make matters worse, some Peloton customers reported issues with their bikes, with a handful suffering injuries. A recall of 30,000 bikes followed.

It didn’t help that rivals were snapping at the company’s heels, with the likes of iFit Health and Echelon offering similar but cheaper products. Peloton filed a patent infringement lawsuit against the companies. The financial strain became more evident when Peloton paused production of new equipment and shelved plans to open a new $400 million factory.

In response to dwindling performance, the company began incentivizing businesses to offer its services as a workplace benefit and added equipment to local gyms, apartments, and hotels. It rolled out the Peloton App Free, a cost-free subscription option offering 50 classes across 12 categories of exercises. The company has also embarked on a rebranding exercise, positioning itself on its app rather than just a hardware brand and seeking to redefine the Peloton brand as accessible to not just people in higher income brackets.

DocuSign is facing headwinds in the e-signature market

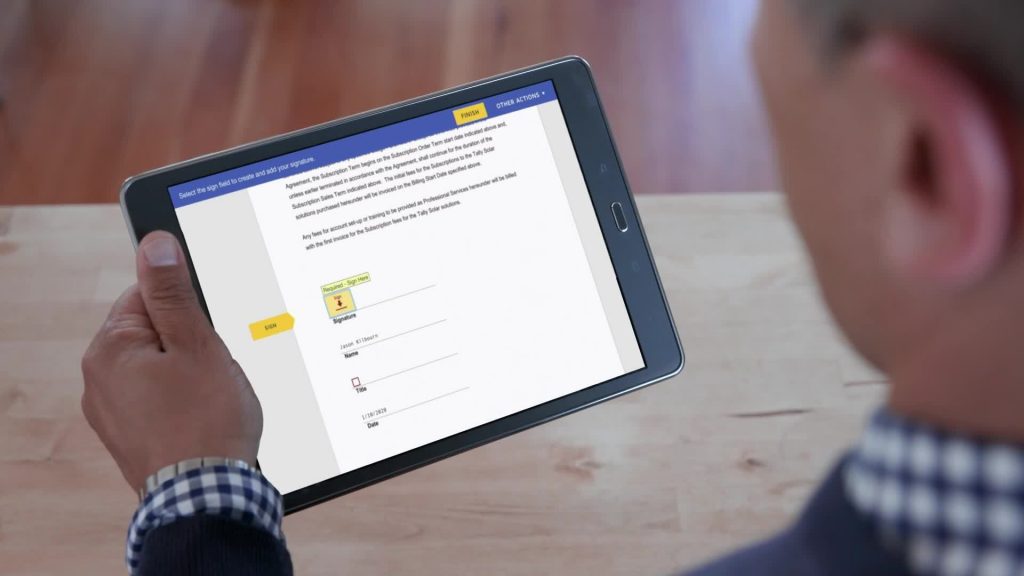

In a digitalized world, it was only a matter of time before document signing with pen on paper began to be replaced by electronic signatures or eSignatures and found a place in business workflows. During the COVID-19 pandemic, eSignatures became more prominent, allowing scattered participants in remote locations to conveniently sign documents and carry on their business and personal work. DocuSign experienced massive growth during the pandemic months but is now facing competition in the e-signature market.

It was a hot tech stock in 2021, closing at a record high of $310.05 that year, amounting to a gain of 969% over its IPO price in 2018. Today, the company’s stock price has dropped sharply to around $50, with the post-pandemic market slowing down sales and macro headwinds making new customer acquisition difficult. In addition, the company faces stiff competition from tech giants like Adobe. An investment of $1,000 in DocuSign shares would have yielded $4,134 during the peak of the pandemic and, by February 2020, fallen to $691.

DocuSign’s strategy has been to expand its product offerings beyond e-signatures to include contract lifecycle management and notary services. An increase in product offerings is a step towards evolving into a more diversified cloud software company like Adobe. As far as the eSignature market is concerned, even as remote work reduces below pandemic levels, the need for eSignature technology is expected to remain high.

‘Pandemic stock’ Etsy has corrected sharply

Etsy, the eCommerce marketplace connecting creators and buyers of customized items, breezed into 202 with shares trading at around $50. By the end of 2020, its stock had gone up 302% to $177.91 per share, earning the moniker “pandemic stock.” Early in the year, the company posted revenue growth of 111%, and its net income soared to 264%, driven by the sale of masks on its platform. But in the fourth quarter, mask sales made up only 4% of sales.

In 2021, the stock fell to $156.59, increased to a high of $296.91, and ended the year at $218.94, up 23%. Revenue increased 35%, and net income rose by 41%. The company ended the year with a valuation unchanged from 2020. By the time 2022 came along, the value of items sold on Etsy was down 1.3% over the prior year, and the company’s stock price had halved.

Despite the stock correction, Etsy managed to hold its own, maintaining high-profit margins and growing its buyer base and average spend per buyer since pre-pandemic. The company has witnessed strong international growth and good performance during the holiday season and special occasions.

Moderna stock is off its pandemic highs

Moderna became a household name for its mRNA vaccine, but the stock has declined 30% in the past year, although its total decline over the past four years is 230%. The COVID-19 vaccine market is less lucrative than before, but Moderna is still generating robust sales and should continue doing it. In 2023, the company had a 48% share of the U.S. market.

Looking ahead to 2024, Moderna is expecting to see $4 billion in sales. However, it’s not all about the COVID-19 vaccines. They anticipate that $3 billion will come from COVID-related sales, which still gives them a competitive edge against Pfizer’s projected $5 billion in coronavirus vaccine revenue for the year.

Moderna is also nearing the release of a vaccine unrelated to coronavirus. Their vaccine for respiratory syncytial virus (RSV), called mRNA-1345, showed promising results in a phase 3 trial last year. They’ve applied for approval from several regulatory bodies, including the U.S. FDA, and are expecting a response in May.

But that’s not all. Moderna has quite a few products in the works that could be ready within the next three years. They’re currently conducting a phase 3 trial for a cytomegalovirus vaccine – something currently unavailable on the market. They’re also working on a combo COVID-flu vaccine, which is currently in late-stage studies.

Wrapping up

The trajectory of “Post-Pandemic Decline” demonstrates that success is not merely about capitalizing on opportunities but also adapting to the shifting market dynamics. The companies discussed in this article each experienced a meteoric rise during the pandemic but are now navigating a landscape marked by reduced demand and heightened competition.

Their stories underscore the volatility of market success and the ongoing need for innovation and strategic adaptation. As we forge ahead, these companies, and many others like them, must evolve their approaches to thrive in a world that no longer operates under the shadow of a global crisis.